Malaysian ICM Continues its Resilience and Dominance with a Stable 65% Market Share in 2022 on the Back of Strong Market Capitalisation and Sukuk Outstanding

The Malaysian Islamic Capital Market (ICM) continued its resilience and dominance of the overall domestic capital market in 2022 despite the ongoing economic and fiscal impact of the COVID-19 pandemic, the supply chain disruptions caused by the Ukraine conflict, and its associated global shocks including a fragile economic recovery, subdued GDP growth, sticky high inflation, rising food and fuel prices, leading to a global cost-of-living crisis which has disproportionately affected the medium-and-low-income developing countries. Mushtak Parker considers the progress and challenges of the Malaysian ICM going forward

According to the latest 2022 Annual Report of the Securities Commission Malaysia (SC) released in April 2023, the Malaysian ICM remains a key component of the Malaysian capital market, contributing 64.38% (compared to 65.4% in 2021) to its total size of RM3,607.29 billion (US$794.82 billion) in FY2022. This despite the fact that the total size of the ICM increased marginally y-o-y by 0.60% to RM2,322.30 billion (US$794.82 billion) in 2022 from RM2,308.54 billion (US$508.66 billion) at end 2021. This comprised a total market capitalisation of Sharia’a compliant securities of RM1,138.53 billion (US$250.86 billion) and total Sukuk outstanding amounting to RM1,183.77 billion (US$260.83 billion).

The country’s capital market resilience in 2022 was achieved amid a year marked by heightened global market volatility and strong headwinds across multiple asset classes. In fact, the buoyancy of the market in 2022 is underlined by the fact that total funds raised of RM179.4 billion (US$39.53 billion) is the highest ever, led by a record amount of corporate bond and Sukuk issuances. This exceeded the 5-year pre-pandemic average of RM121.4 billion (US$26.75 billion).

The growth trajectory of the ICM has been on an upward trend since 2019 with the y-o-y growth rising from 3% in 2019 to a peak of 7% in 2020 before dropping to 3% in 2021 and 0.6% in 2022. Whether the ICM growth is flattening out is a moot point. It is probably more due to market volatility and a decline in valuations. After all, the market share of the conventional capital market has similarly remained flat.

Dato’ Seri Dr Awang Adek Hussin, SC Chairman, emphasised that “the Malaysian capital market remained orderly and continued to finance the economy, with total funds raised hitting a record high of RM179.4 billion. The 2022 performance was achieved despite increased global market volatility and headwinds. Globally, the capital market registered weaker performance in 2022 with the continued tightening of financial conditions in major markets, inflationary pressures, and the repercussions of the Ukraine war.”

The continued resilience of the Malaysian capital market, he added, highlighted the value of exercising prudence and shared accountability while capitalising on growth prospects that arise. “This approach allows the market to better manage risks, preserves overall financial resilience and stability, and supports economic growth,” he said.

It is worth noting that the Malaysian capital market continued its impressive progress in Gender and Diversity employing 53.8% females compared with 46.2% males in 2022. This translates into 829 women employed in the industry at end December 2022. However, an overwhelming majority 77.3% are employed in middle management and executive appointments. Only 1.7% of women made it to top management in 2022.

The key highlights of the Malaysian capital market in 2022 included:

a) Equity crowdfunding (ECF) and peer-to-peer financing (P2P) platforms continue to facilitate the funding needs of micro, small and medium enterprises (MSMEs), with the total funds raised recording an increase of 26% from RM1.4 billion in 2021 to RM1.7 billion in 2022. Since their inception, ECF and P2P have helped 7,218 MSMEs raise over RM4.4 billion.

b) The ICM comprising total Sukuk outstanding and Shariah-compliant equity market capitalisation, saw a marginal increase by 0.6% compared to the previous year. The ICM has increased at a compound annual growth rate (CAGR) of 4.2%, driven by the increase in total Sukuk outstanding (9.3% p.a.) while Shariah-compliant equities remained relatively flat (0.1% p.a.).

c) Ongoing efforts to broaden and deepen the ICM were made, including the issuance of the Guidelines on Islamic Capital Market Products and Services to facilitate efficient access to the ICM ecosystem.

d) The capital market continues to prioritise good corporate governance and sustainability practices. As of 1 March 2023, 29.7% of board positions on the top 100 public listed companies (PLCs) are held by women, and all top 100 PLCs have at least one woman director on the board.

e) To address scams and unlicensed activities, the SC established an internal task force as a proactive measure to ensure that such activities are identified and dealt with in a timely manner. In 2022, 185 websites were blocked and 304 new entries were added to the SC’s Investor Alert List, compared to 143 websites and 134 new entries in 2021.

f) In 2022, the SC took criminal and civil actions related to various serious breaches such as disclosure breaches, securities fraud and unlicensed activities which resulted amongst others, numerous criminal convictions and RM12.9 million in total fines.

The SC data reveal that the ICM fared better than its conventional counterpart in several market share segments. Malaysia’s vibrant Sukuk market continued to hold its own in 2022.

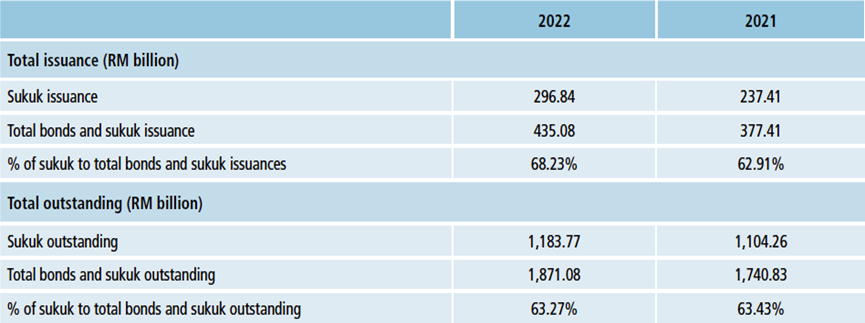

Despite adverse market conditions, total Sukuk issued in 2022 reached RM296.84 billion (US$65.40 billion) or 68.23% of the total bond and Sukuk issuance market of RM435.08 billion (US$95.86 billion). Bonds issuances reached a total market share of RM138.24 billion (US$30.46 billion) or 31.77%. This compared with total Sukuk issuances in 2021 of RM237.41 billion (US$52.31 billion) (62.91% of the total bond and Sukuk issuance of RM377.41 billion) (US$83.16 billion), and RM223.94 billion (US$49.34 billion) (61.07%) in 2020.

Similarly, total Sukuk outstanding in the same period amounted to RM1,183.77 billion (US$260.83 billion) which is 63.27% market share of total bonds and Sukuk outstanding of RM1,871.08 billion (US$412.27 billion). Bonds outstanding reached RM687.31 billion (US$151.44 billion) with a market share of 36.73%.

The buoyancy of the Sukuk market was further underlined by the fact that total Sukuk outstanding has steadily held its own increasing from RM1,017.79 billion (63.26%) in 2020 to RM1,104.26 billion in 2021 (63.43% of the total bond and Sukuk outstanding of RM1,740.83 billion in 2021) and the RM1,183.77 billion in 2022.

Malaysia Total Sukuk Market Share Data 2021-2022

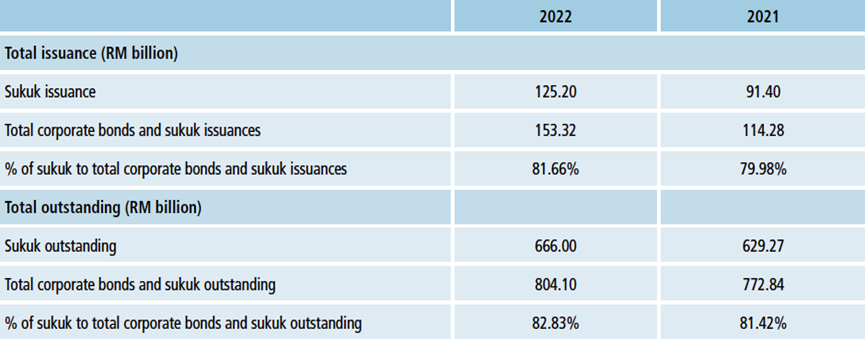

Malaysia Corporate Sukuk Market Share Data 2021-2022

Corporate Sukuk issuances represented 81.66% market share (2021:79.98%) of total corporate bonds and Sukuk issuances while corporate Sukuk outstanding accounted for 82.83% (2021: 81.42%) of total corporate bonds and Sukuk outstanding. Total corporate Sukuk issued in 2022 reached RM121.20 billion (US$26.70 billion) – up from the RM91.4 billion (US$20.14 billion) in the previous year.

Total Sukuk issuances in 2022 represented 68.23% (2021: 62.91%) of total bonds and Sukuk issuances whereas total Sukuk outstanding represented 63.27% (2021: 63.43%) of total bonds and Sukuk outstanding. According to the SC, seven issuers issued SRI sukuk in 2022, bringing the total of SRI Sukuk issuers to 25 since 2015. While this may give the impression of a robust SRI issuance culture, it still falls well short of the SC’s ambition of advancing the ESG and sustainability Sukuk and bond issuance agenda. Malaysia for instance is way behind Indonesia in issuing Green Sukuk, especially sovereign offerings.

Corporate SRI Sukuk issuances in 2022 amounted to a mere RM10.58 billion (US$2.33 billion), which was 8.45% of total corporate Sukuk issuances, albeit corporate SRI sukuk outstanding grew to RM17.93 billion (US$3.95 billion) as at December 2022 from RM8.11 billion (US$1.79 billion) in 2021, constituting 2.69% of total corporate Sukuk outstanding. Compared to the Sukuk market, the Islamic fund management industry is the poor relation of the Malaysian ICM. Total assets under management (AUM) at end December 2022 stood at RM205.86 billion (US$ billion) registering an 8.43% decrease from RM224.80 billion as at end 2021. This compared with the total fund management industry AUM which similarly declined to RM906.46 billion in 2022 from RM951.05 billion (US$ billion) in 2021.

The number of Islamic CIS, unit trust fund (UTF), wholesale fund (WF), PRS, real estate investment trusts (REIT) and ETF stood at 404 as at December 2022 including 20 Islamic SRI funds. There were 57 FMCs managing Islamic funds, with 24 IFMCs and 33 FMCs with Islamic windows as at December 2022. The ICM had 85 SC-registered Shariah Advisories in 2022, comprising 65 individual advisers and 20 incorporated advisories.

Looking ahead, the trajectory of the Malaysian Capital Market in 2023 will focus inter alia on regulatory reforms, enhancing the fundraising ecosystem, advancement of the ESG agenda, facilitation of technology adoption and improving corporate governance. The SC will also prioritise sustainability and talent development to ensure the capital market continues to contribute to broader social and environmental goals.

The performance of the Malaysian capital market is projected to remain resilient, in line with the domestic economy. However, it will continue to be influenced by key global developments, with volatility expected to be driven by the rate of global monetary policy tightening and geopolitical developments. Nevertheless, conditions in the domestic capital market are expected to remain orderly, and continue to support the economy, underpinned by strong macroeconomic fundamentals and supportive capital market infrastructure.

“As we look towards the future, the SC remains committed to pursuing initiatives that will further strengthen Malaysia’s capital market and enhance its role as a catalyst for economic growth and development,” added Dr Awang Adek Hussin.

Leave a Reply